Table of Contents

Overview

Actionstep comes with a full Foreign Currency ability. Foreign Currency is where you are holding Foreign Currency Bank Accounts. You may do Sales in USD and hold funds in USD, your base currency being NZD. For the puposes of reporting these transactions will be converted at the rates in your system - where the rate has changed since the transaction the system will create "Unrealised Foreign Exchange Gain/Loss". This gain/loss is "Realised" when the funds are converted with a bank transfer in/out of your local currency.

How this is calculated?

We split our Foreign Exchange (FX) up into 3 sections:

...

All three are calculated on the fly and have detailed breakdown reports to justify their numbers. We do this because it prevents the system from creating inconsistencies with back/future dated transactions and/or changes to the historic exchange rates.

This also (potentially) allows us to work in more then 2 currencies, so you could invoice in USD, pay in AUD and report in NZD.

...

| Note |

|---|

Actionstep does not consider a purchase in a Foreign Currency out of your Local Currency to be a multi-currency transaction (your local currency left your bank account). At the moment these types of transactions will need to be manually calculated. An alternative would be to set up "dummy" FX accounts and transfer the funds into your base currency on receipt. |

Foreign Currency Set Up

This is an Administration function.

...

- Currency Code - three letter currency code as used by your bank

- Currency Description - a singular description of the currency (ie United States Dollar)

- Unicode (hex) Symbol* - a unicode number of the symbol used for the currency (common options are in a combo box next to the input field) Unicode is a universal number used to assign a symbol to a font. The current list has been taken from:http://unicode.org/charts/PDF/U20A0.pdf

System Accounts for Foreign Currency

In order for the background calculations in Actionstep, a number of your system accounts need to be set up for each currency.

For example: If your base currency is NZD USD and you also trade in AUDCAD, you would need to let the system know where to Put the Accounts Receivable, Payable, Bank transactions, Tax, Deposits paid and received.

| Info | ||

|---|---|---|

| ||

|

...

For the FX Gains/Losses revaluations etc to calculate, you will also need system accounts for these calculations (or you won't balance).

The following Accounts will need to be set up subsequent to our release of 20/08/2010 for current Multi-currency clients.

...

|

| System Account | Should it have it's own account in your chart of accounts? | Existing account in chart of accounts for this system account | Example Account to create and use for secondary account | Explanation |

|---|---|---|---|---|

| Sale/Purchase Rounding Errors | No | 6-9999 - Sale & Purchase Rounding Errors | When 1c rounding errors are detected in a database, the difference is posted to this account.. Can occur in FX or BASE currency and appears to only occur when invoice is inclusive of tax |

...

...

| FX Gain/Loss Receivables Realized |

...

| Yes | n/a | 4-8310, 4-8312, etc | Difference between sales invoice posted rate and the actual payment rate. |

...

| FX Gain/Loss Receivables Unrealized |

...

| Yes | n/a | 4-8320, 4-8322, etc | Difference between sales invoice posted rate and the current rate for un-paid amounts. |

...

| FX Gain/Loss Payables Realized |

...

| Yes | n/a | 4-8330, 4-8332, etc | Same as above but purchases.. Can be linked to the same account for convenience if wanted. | |

| FX Gain/Loss Payables Unrealized | Yes | n/a | 4-8340, 4-8342, etc | Same as above but purchases.. Can be linked to the same account for convenience if wanted. |

...

| FX Gain/Loss Bank Revaluations |

...

| Yes | n/a | 4-8350, 4-8352, etc | Money gained or lost in bank transactions based on the value of the money deposits/withdrawals vs the current calculated balance. |

...

| FX Gain/Loss Other |

...

| Asset | Yes | n/a | 4-8360, 4-8362, etc | This calculates the revaluation of asset accounts which have a non base currency (excluding bank + linked A/R + A/P accounts). |

...

| FX Gain/Loss Other Liabilities |

...

| Yes | n/a | 4-8370, 4-8372, etc | Same as assets, but for Liabilities :) |

...

If you are actively using 3 currencies, then they need to link all 3 currencies for each system account. They can all be in the same account though.. you could create one account called "FX Gain/Losses" and link every system account with every currency to it. However you are also free to create one account for every currency and every system account if you want to see explicit detail on your income statement.

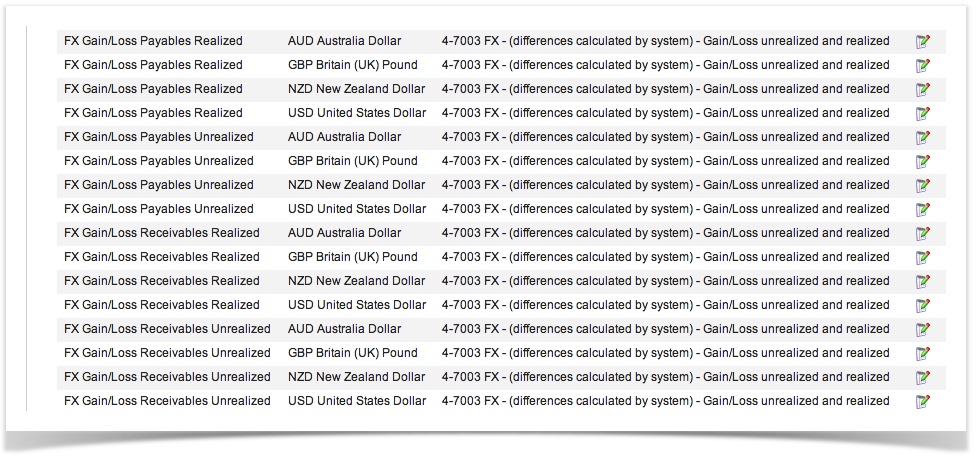

Below is a sample of a section of the System Accounts - showing that they are mapped for every currency and in this example all mapped to the same income account.

...

| Accounts Payable | Yes | 2-1210 - Accounts Payable | 2-1220, 2-1220, etc | A system account that controls what is due to be paid to your debtors. An account in your chart of accounts will have to be created for each currency you will be paying invoices in and it will have to be mapped as a system account. |

| Accounts Receivable | Yes | 1-1710 - Accounts Receivable | 1-1720, 1-1725, etc | A system account that controls what is due to be paid to your creditors. An account in your chart of accounts will have to be created for each currency you will invoice in and it will have to be mapped as a system account. |

| Customer Deposits | Yes | 2-1600 - Deposits Received | 2-1610, 2-1615,etc | A system account that offsets your deposits when a debtor pays you. An account in your chart of accounts will have to be created for each currency you will invoice in and it will have to be mapped as a system account. |

| Supplier Deposits | Yes | 1-1600 - Deposits Paid | 1-1620, 1-1630, etc | A system account that offsets your withdrawals when a creditor pays you. An account in your chart of accounts will have to be created for each currency you will invoice in and it will have to be mapped as a system account. |

| Electronic Payments | No | The other currency bank account you have created. | This controls what bank accounts details will show on your invoice. Link this to the bank account that you have setup for that currency. | |

| Invoice Payments | No | The other currency bank account you have created. | This controls who invoice payments will be paid to by default. You will not have to create a new account in your chart of accounts but you will have to create a system account for this in each currency that you operate in. | |

| Invoice Receipts | No | The other currency bank account you have created. | This controls who invoice payments will be receipted to by default. You will not have to create a new account in your chart of accounts but you will have to create a system account for this in each currency that you operate in. | |

| Sales Tax Collected | Yes, if billing taxable amounts in another currency | 2-1310 - Sales Tax Collected | 2-1312, 2-1314, etc | While not common there could be instances where you are charging sales tax in another currency. If this is the case then a new account should be created in the chart of accounts and mapped as a system account. |

| Sales Tax Paid | Yes, if paying taxed amounts in another currency | 2-1330 - Sales Tax Paid | 2-1332, 2-1334, etc | While not common there could be instances where you are paying sales tax in another currency. If this is the case then a new account should be created in the chart of accounts and mapped as a system account. |

Exchange Rates

Administration . Accounting > Exchange rates

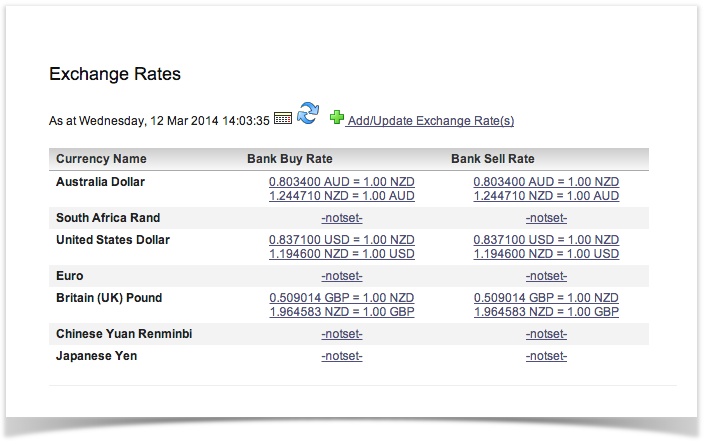

This screen lists the current known exchange rates in relation to the Local Currency as specified in the CONFIG screen.

There are three main functions of this screen:

- View current or historic exchange rates

- View the history of a single currency

- Add more current or historic exchange rates

Viewing Exchange Rates

By selecting a date in the Calendar Control and clicking the Refresh button , the visible list will show the known exchange rates as at that date/time. By default, the current date/time is used.

Viewing History

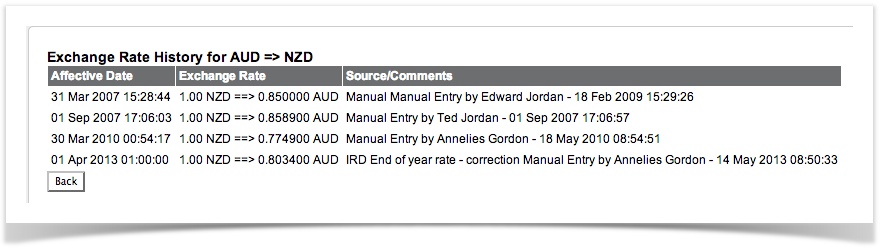

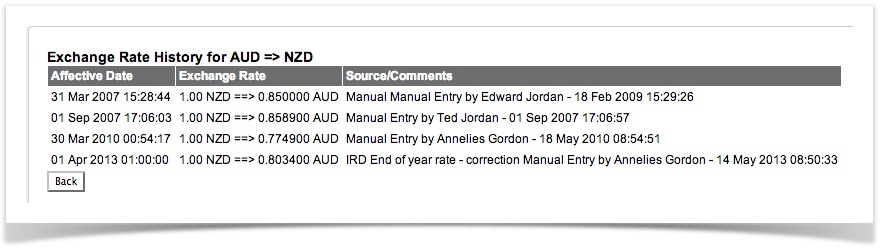

By clicking the link on any of the currencies listed, you can view the history for that entry. The history will show Affective Date, Exchange Rate and the Source/Comments of the data.

Entering Rates

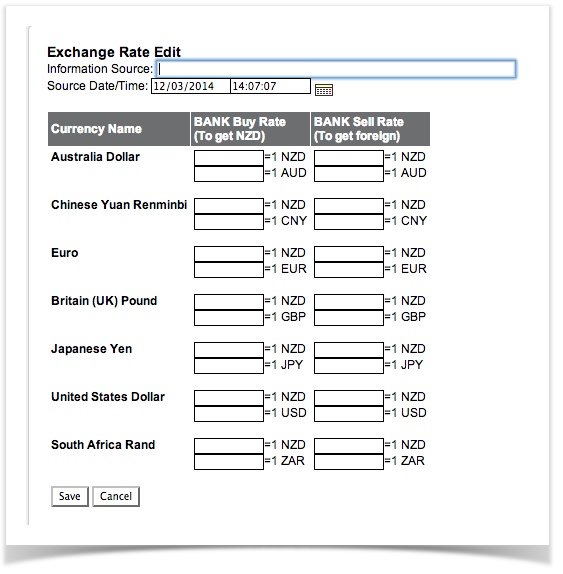

By clicking the "Add/Update Exchange Rate(s)" link, you will be taken to a new screen. In this screen, you will be presented with 4 input boxes for each foreign currency.

BANK Buy Rate (to get 1x Local Currency)

BANK Sell Rate (to get 1x Foreign Currency)

Each one of these is then broken up into two options: [ value ] = 1 Local Currency, [ value ] = 1 Foreign Currency

You only need to enter one of the two options and it will automaticly calculate the other (using 1/X to calculate).

When entering data from your local bank or foreign exchange agent.

BANK BUY - This is the rate that the BANK will exchange your foreign currency for your local currency.

BANK SELL - This is the rate that the BANK will exchange your local currency for foreign currency.

These numbers should be slightly different depending on your banks markup on the currency. This data is NOT designed to be the actual cost of exchange, rather a guideline for your expected income. Most businesses will hold the foreign currency until the local currency is doing well, then convert a lump sum to make a profit on the exchange and to also avoid bank exchange fees for small amounts.

You only need to enter the values that have changed, any blank fields will not be altered.

FX Contract Example

The following example explains the process for managing FX Contracts. This method removes the forex gain/loss from the trader. If your policy is always to hedge forex sales then you need to factor in the cost of the hedge (not the resulting gain/loss) into your cost of sales. This is no different than factoring in freight etc into cost of sales.

...

b) If the exchange rate is neutral or in your favour e.g. you would get >= NZ$1,500 for the the US$1,000 then do not exercise the option and just transfer the money into the NZ$ bank. The system will automatically record a Forex Gain/Loss when you convert the money to NZ$.

Reports

In order to see where the FX figures on your Income Statement come from, see the report

...

Also see here for more FX reporting options.

Entering Hedges

This is the method for entering hedges into Actions.

In a nutshell, you represent the hedge as a purchase of the foreign exchange (FX) cover from the bank as an FX purchase invoice at the agreed-upon hedge rate (which should be the rate the sale was recorded at). You simultaneously record a sale to the bank of the NZ amount of the hedge (which should be the NZ value of the sale invoice if fully covered by the hedge). This will "float" with the sale invoice and offset any gain/loss.

On the day that payment is received you pay the sale invoice and both purchase invoices to the bank.

Example

If you have a US sale for US$1,000 on 17th July when the rate is 2.00 it will result in a NZ$2,000 sale. You receive payment pm 20th August when the exchange rate is 1.25 resulting in a $750 FX loss (if unhedged). This is how to hedge this sale.

...