...

This is the area of the system where the GST/VAT/Sales Tax is configured to match your local tax jurisdiction. You can set the 'GST_Alias' in the Admin area so that your system will refer to GST as GST/VAT, or Sales Tax throughout the application.NOTE:

| Note |

|---|

In Actionstep we refer to INPUT tax as tax coming into the firm (tax collected on sales), and OUTPUT tax as tax going out from the firm (tax paid on purchases). |

Global Tax Return Plugin List

...

There are two steps to setting up your system to use a Tax return plugin:

| Table of Contents | ||

|---|---|---|

|

Set the tax return plugin

Firstly set the sales tax return that your system will use. To do this go to Admin > Accounting > Tax Return Plugins.

...

You will likely have a plugin already installed. There will be one listed item on screen and that should correspond to the tax return needs of your country. You can click on it to change the plugin from what it is currently set to to another.

If there is not a plugin listed, click "+Install Plugin" which will in the top right of the screen, which will give you a list of any available plugins. There are currently three options. One for New Zealand, Australia and For the UK.

| Note |

|---|

...

|

...

| |

| If you |

...

This gives you a list of the Tax Returns installed for this division

- To add a return type to a Division, click the "+Install Plugin" button.

- To edit an existing plugin, click on the notepad icon or the identifier name.

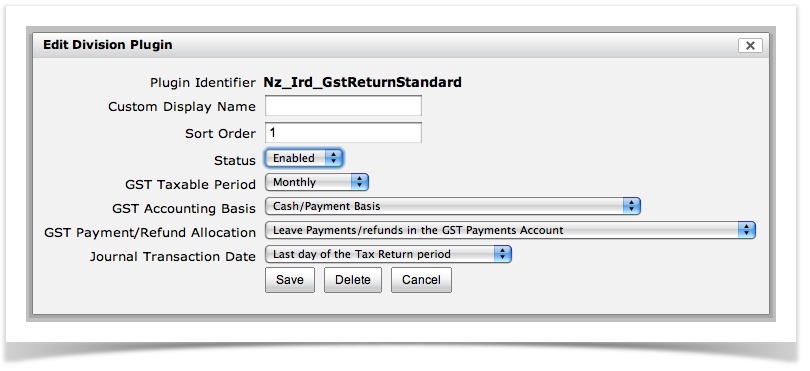

Configuration options for the Return plugin

Edit as required:

1. Custom Display Name: Name the return

2. Sort Order: When you have a list of different returns, where would you want this to sit (at the moment GST is1 as there are no others)

...

| have a system with more than one division you can setup a tax return plugin per division. Login to a division and access the tax return plugin screen (Administration > Accounting > Tax Return Plugins) to set the return for that division. Then move to the next division and set the plugin and the settings for that division. |

Entering the settings for your tax return

Now that the plugin is in place, you want to enter some settings for it. Go to Admin > Accounting > Tax Return Settings and click on the listed item that is there.

Now fill in the settings that you want to use for your tax return.

Edit as required:

| Field | Explaination |

|---|---|

Custom Display Name | Name the return. Eg, "GST Return" or "BAS Return". |

Sort Order | If you had more than one return configured you could enter a number to select what order the reurns would be displayed in. a return with a lowerr number will appear above a return with a higher number. |

Status | Enabled - currently using. Disabled - no longer registered. |

...

GST Taxable Period |

...

| How often do you file |

...

| your return. There will be different options for different countries returns. | |

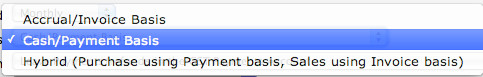

Accounting Basis | Select your basis - If you do not know, check your correspondence for the Government Agency which deals with this.

|

...

...

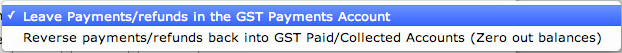

| Payments/ Refund Allocation |

...

Leaving payments will just keep adding the payment figure - the balance sheet will always shown everything paid, every thing collected and every amount refunded or paid to IRD. We recommend using: Reverse |

...

payments will clear out the balances and offset them against the appropriate account. It will do this by creating the Journal at the specified date (see below), as soon as the GST return is marked as filed. The balance left in the GST payments account will match the return and clear when the payment is processed. |

Note: this is a new feature at the Nov 10 release, if you take the option of clearing the accounts it will not do so for any retrospective returns - should you wish to do this, please contact the Actionstep support team.

...

| Journal Transaction Date |

...

| Specify the date in which any Auto Journals created will post to your ledger. |

| Info | ||

|---|---|---|

| ||

If you are in the UK and your database was created prior to the release of our VAT return plug-in (May 2014), you may need to link the system account for refunds|payments of the VAT. This will enable the processing of the payment through the VAT return. |

...