ASB is a New Zealand based bank that has a powerful online trust management tool to help you deal with the funds you hold in trust for clients. Actionstep has an integration with ASB to make it easier and faster for you to handle some basic tasks in Actionstep when you do your Trust banking with ASB.

| Table of Contents |

|---|

Features of the ASB Integration

Bank reconciliations

When you go to process a Trust bank reconciliation in Actionstep you can choose to do an Electronic statement upload. When you choose this, n screen it will give you directions on where to go in your ASB FastNet Online banking to download the file to use for this reconciliation.

...

This Actionstep will automatically be configured to accept this file format. Once you have done this once, each new bank reconciliation you do will default to doing an Electronic statement upload.

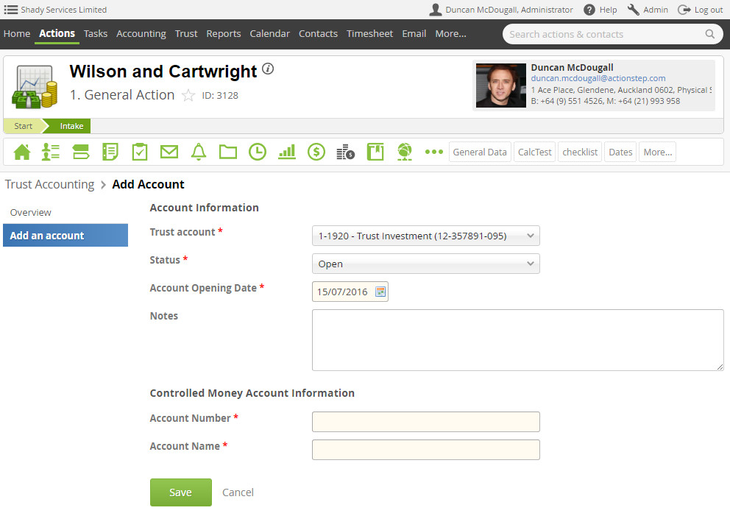

Investment Account details

Once integrated, each time you go to open your trust investment account for a matter you will be prompted to enter in the bank account name and bank details of the account that you create in the ASB Professional Trust online banking. This makes it easier for you to keep track of your accounts in Actionstep so you can see how they match up.

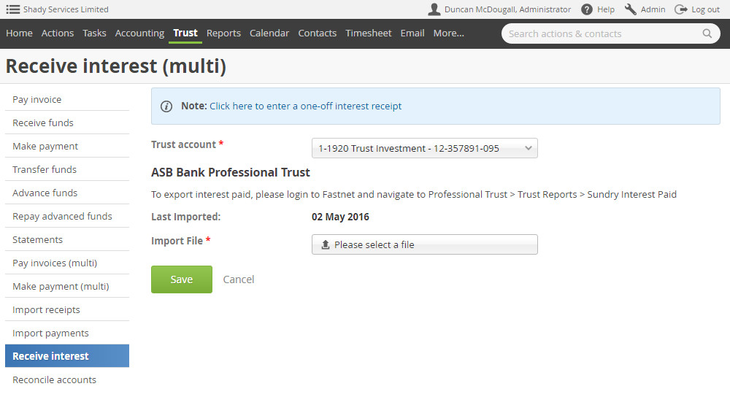

Receiving Interest

You can easily receipt interest into an investment account using a file exported from your ASB FastNet Online banking. When you go to Receive Interest on Trust Investment Accounts (Trust > Interest > Receive interest (multi) and you select the Investment account it will provide, on screen, instructions for how to source the file from your ASB FastNet Online banking.

The import will automatically be configured to accept the format that the file is in. All you have to do is upload the file and click Save to process it.

Setting up the ASB Integration

| Note |

|---|

You will need to be an Actionstep Administrator to be able to do this. |

...