...

Depending on your jurisdiction and | or or your business type, you may be required to record Sales Tax (either on your sales|income or on your purchases|costs).

...

| Info | ||

|---|---|---|

| ||

To change the name of your Tax type: GST VAT HST etc go to Account Preferences and update your system alias for Sales Tax |

...

Tax Codes and Rates

There are a few different scenarios where you may be required to either add or edit tax rates.

...

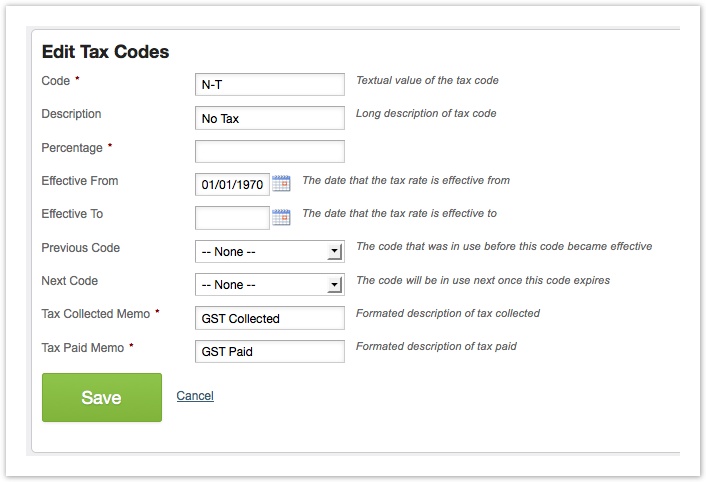

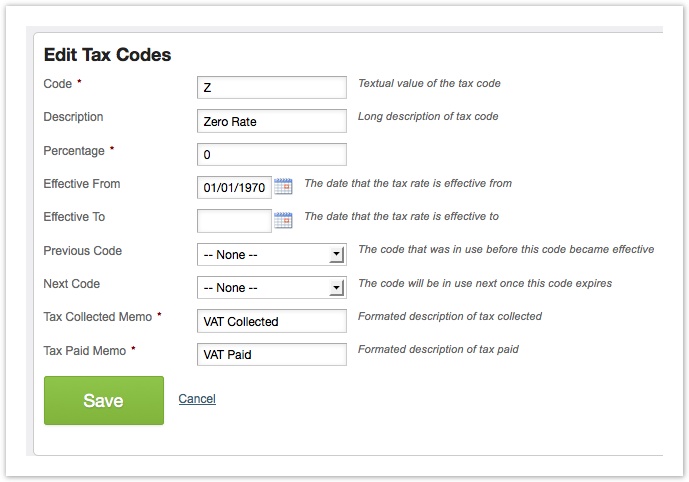

In this case changing the N-T tax rate to zero rate VAT (this will update all the accounts with N-T as the current tax rate).

Before

Changed to

We have also changed the standard tax rate of 10% to 20%.

...

| Note | ||

|---|---|---|

| ||

If you are adding a tax rate for a specific purpose: remember to update any areas where this Tax Rate should be default. Possibly the Chart of Accounts or the Rate Sheets |

Replacement Tax Rate

If your sales tax rate is changing, it is likely to change as at a specific date. A new Rate will need to be set up in specifying which tax code it replaces and when this will start.

This will allow you to enter transactions in arrears and in advance of the change and the system will update as required.

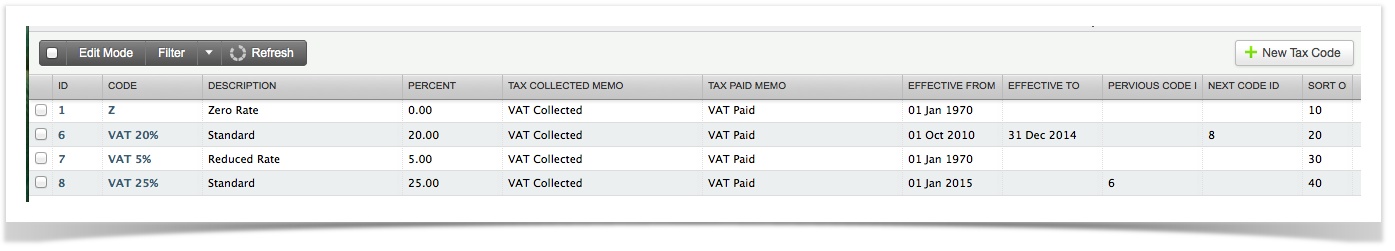

In our Example we are going to change the VAT standard rate to 25% as at 1/1/2015.

...

Now our list looks like this - you will always have a history showing the time lines of each of the rates.

To Delete a Tax Rate

It's unlikely that you'll need to delete a tax rate, if you do

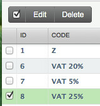

Select the check box beside the Rate you wish to delete. This will open the multi-row functionality and the delete option will appear

You will be asked to confirm - Twice.

| Warning | ||

|---|---|---|

| ||

If this tax code is in use, you will not be able to delete it without adjusting every instance of where it has been used. |

...