Managing a credit card account in Actionstep is quick and easy. That said, there are some minor difference in best practices when managing a credit card account and a bank account.

Setting up a Credit Card in Actionstep

By default, your Actionstep database will come with two easily configurable credit card accounts. You may notice that this account is found towards the bottom of your accounts list under the "Liabilities" section. This is because a credit card balance is considered a liability. To begin using these you must first Link the Credit Card Account. If you haven't already you will need to create a bank contact. Once this is done you can select "Link Credit Card Account" and follow the same steps found in our "Link Bank Accounts" user guide.

Creating Payments using a Credit Card

Credit Cards can be used for supplier invoice payments and withdrawals. Simply choose the correct credit card from the "Bank Account" dropdown when creating the transaction

Transferring Funds from your Operating Account to your Credit Card

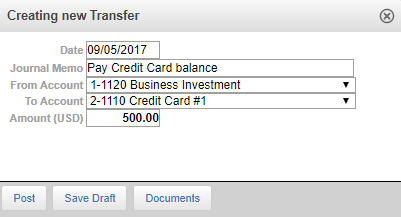

To pay the current balance on your Credit Card account simply create a transfer from your operating to your credit card accounts (banking>transactions>New Transfer)

| Note | ||

|---|---|---|

| ||

Payments on supplier invoices and withdrawals created using a credit card will create a credit in your credit card account. Transfers from operating to the credit card create a debit |

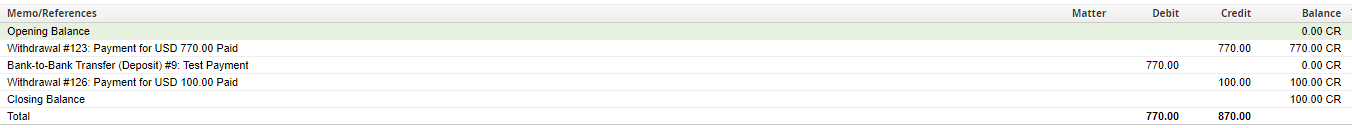

Reconciling Credit Card Accounts

Because credit card balances are liabilities to the firm, closing balances for credit card accounts should be entered as negative numbers. Entering positive balances for credit card accounts will cause your reconciliation to be out.

...

| Info |

|---|

See updated article in Actionstep Help Center: https://support.actionstep.com/hc/en-us/articles/360055455333 |