Prior to setting up the xero interface - check the chart of accounts in Xero

Depending on the purpose of the Integration, you will need to ensure that Chart of Accounts will allow the required transactions. We suggest that you think about this prior to Integration as the way you run your transactions will need to map correctly for the transactions to feed without issues. Once you have the correct chart of Accounts in Actionstep, you can then make sure you have the accounts in Xero to feed to - prior to Integration.

| Note | ||

|---|---|---|

| ||

A high portion of clients using the xero integration are doing so to track Trust Accounting. As xero does not support Trust Accounting it is highly likely that you will need to add these accounts to your xero system prior to integration. Trust Bank Account or Accounts - a bank Trust Liability Account - a liability which must allow payments from the account Trust Transfers Account - a liability which must allow payments from the account (If you are in a jurisdiction that uses Firms interest in trust, eg, New Zealand) Trust Client Advances Account (Paid by Firm) - an Asset account which must allow payments (If you are in a jurisdiction that uses Statutory Deposit Accounts, eg, Australia) Trust Statutory Deposit Account - A Current Asset account which must allow payments |

Pointers for matching the Accounts lists.

...

In some jurisdictions the account for Bank to Bank Transfer Holding needs to be mapped to an Income Account in order to work correctly - this is due to a limitation in the Xero API for transfers.

| Note |

|---|

The Xero system will let you save an account with no code, the API will not accept this. Please ensure that ALL (even inactive) Xero accounts have a code. |

Which way is best for integrating Xero?

The Actionstep to Xero interface relies on Actionstep being told which account it is posting to in Xero when a transaction is saved. In order to do this a Xero extension is added to your actionstep system. This extension will link to xero (using the username and password you put in) and post the transactions through so it needs to know where the transaction is going. For example you may have an account (or accounts) for Fees in Actionstep and these may point to an account with the same name in Xero.

This is done via a "Mapping" screen in the Xero configuration area in your Actionstep system.

When the Xero Extension is installed and the Xero connection made, Actionstep will pull from Xero the:

- Chart of Accounts

- Tax Codes

- Currency

Requesting the Xero Extension

Once you have selected which option you would like for your Xero Configuration please send support@actionstep.com an email requesting that the Xero extension be added for organisation key xxxxxx.

Please ensure that you have read the options below prior to the request.

Configuring the Xero Interface

Step 1. Connecting to Xero

Connect to Xero at the bottom of your screen (where it currently indicates a disconnected xero)

Login to Xero using the login you wish Actionstep to connect with - this must be a high level access (capable of processing Journals)

Authorise access - ensure you have the correct Xero company (if you have access to multiple Xero accounts).

Once connected the green connected indicator will now show.

Step 2: Map the Accounts & Synch the Requirements

| Info | ||

|---|---|---|

| ||

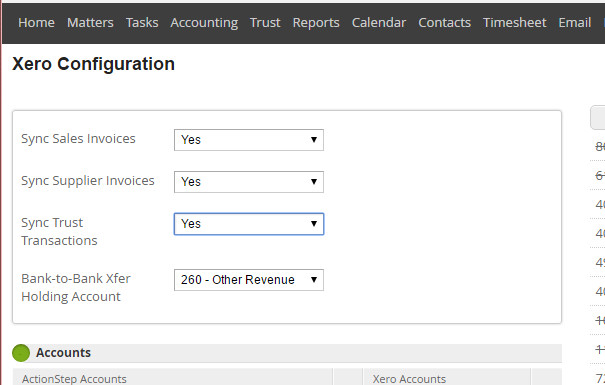

Admin > Plugins > Xero > Xero Configuration |

The top section of this screen allows you to tell the system which types of transactions you are sending through.

Usually this would be Sales Invoices and Trust accounting. If you are using Purchases we do recommend that you think about whether you want these pushed through and your reasons for using them - this can cause duplicates in your Xero system.

| Note |

|---|

The Account for Bank to bank transfer must be a Revenue account (we need this to cope with differences in our system to Xero). You may want to use an existing account or create a new account on your Xero chart of accounts to use for this. |

Map the Accounts

Map the required Accounts from your Actionstep system to your Xero Accounts - see note below.

When a Xero Account is selected for mapping a line will go through it. Please check to ensure that all the xero accounts you require are marked as being used.

At the least you should map through the accounts mentioned below.

...

(Only for firms that are in a jurisdiction that allows FIrms Interest in Trust, ie, those operating trust accounts in New Zealand)

If you will be using the Paid by Firm function in your trust accounts (making payments on behalf of the client before funds are received) then this account will have to be mapped. You may need to create this account in your Xero Chart of Accounts as an Asset Account that allows payments. This is not a standard Xero account.

...

(Only for firms that are required to transfer a portion of their trust funds to a Statutory Deposit Account)

If applicable this will have to be mapped. Note that even though the account is a bank account in in your Actionstep Accounts list it should be mapped to a correspondingly named Current Asset account in your Xero chart of accounts.

...

All Income accounts such as "Fees" and "Disbursements" and "Other Income" should be mapped across to the equivalent Income account in Xero.

...

When manual mapping you will find that most of the accounts in xero do not need to be mapped as they may not relate to the Activity you are using Actionstep for. For Example, typically you would not be processing day to day expenses in Actionstep, so you do not need to map the accounts for expenses. Once you have finished and successfully used your integration you could also deselect these from your Actionstep Accounts list.

Map the Tax rates

Select the Tax rate mapping - NOTE: Tax on Income is Output, on Costs it is Input Tax. It would pay to map all rates as at some point you may need an exempt rate as an oddity. As you are manual mapping, you should also find any new ones which are in Actionstep and map them to xero - typically Actionstep may have a "Standard Tax" which needs mapping (or replacing in the tax settings)

select image to enlarge

Map your currency

Make sure that the currency is selected properly.

| Info | ||

|---|---|---|

| ||

The Actionstep | Xero Integration does not support Multi-Currency |

| Note | ||

|---|---|---|

| ||

At times it may be that you need to add new accounts, the Xero configuration does not automatically update when accounts are added in Xero. If you have added accounts in Xero you will need to Refresh the Chart of accounts to bring these into Actionstep for mapping. This will not lose the mapping you have already done, but will allow further mapping. |

...

| Info |

|---|

See updated article in Actionstep help Center: |