| Table of Contents |

|---|

The Bank Account configuration in this version of Trust Accounting is where a lot of the complexity is held.

- The Docx Templates for Trust Receipts, Trust Statements, EFT requisitions (Australia), Payment confirmations

- Default email templates for the bulk sending of Trust Receipts or Statements

- Settings for the Bulk Statement run (who to include or exclude)

- The Bank "plug ins" for any banks we have presets for.

| Info |

|---|

For information on how to enter your Trust Bank Accounts you can watch the below video or see the text underneath the video. |

| Widget Connector | ||

|---|---|---|

|

| Note |

|---|

If you have a trust account for on call deposits and a separate one for term deposits you should create separate trust investment accounts for these as both should be reconciled separately. If you are unsure if you have two separate accounts for each, check with your Law Society. |

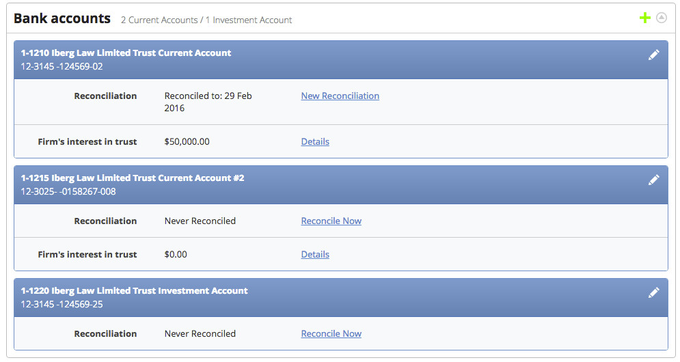

Viewing the available Trust Bank Accounts

To view the available bank accounts, click the downward arrow in the Trust Admin screen.

This will bring up a screen as below - note: there are jurisdictional components to the Bank configuration - your system may not look exactly the same.

Each section shows:

- The bank account name and number

- Last reconciliation date (and a link to reconcile - this can also be completed using the main Trust application)

- Other financial factors affecting this account - Firm's Interest in Trust value, Statutory deposits, etc. (plugin specific) and a link to see the related transaction list.

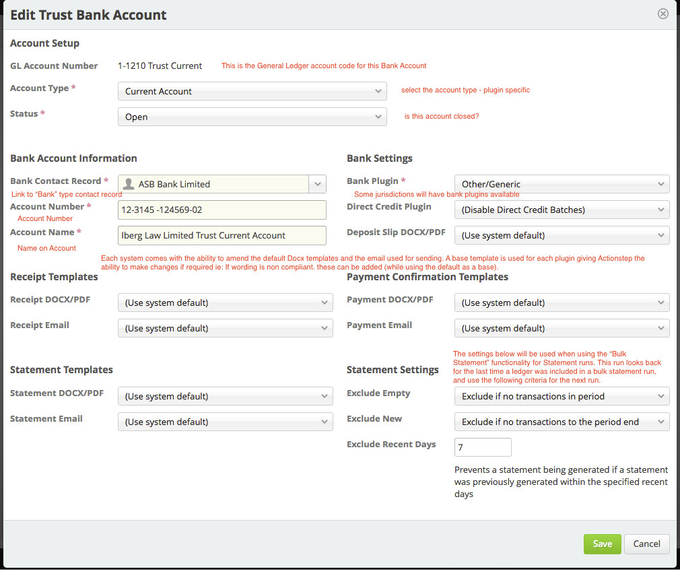

Understanding the Bank Account Configuration

Click on the To view the configuration for the Bank Account. The screenshot below describes the fields.

| Info | ||

|---|---|---|

| ||

Only Current Accounts, Investment Accounts and Controlled Accounts can be added as a Trust account. |

System number Sequences

You can use this section to adjust any of the numbers in your system. If you update the numbers displayed will be the next number that will be created for that type. For example, if you enter "1002" for your receipts number the next receipt number will be 1002. The number displayed is not what the next number in your system will be but what the number sequence started at.

You can move numbers up to a new higher number but never down to a lower number.

| Warning |

|---|

This function is only for users creating a new Actionstep account so that their numbering in Actionstep match their previous system's numbering. It should not be altered once any transactions have been entered. Doing so will cause a gap in your numbering sequence which is NOT acceptable in regulatory bodies that we are aware of. |

Trust Account Definitions

- Current Accounts are typical Trust accounts that do not incur any interest.

- Investment Accounts are sometimes called IBDs or Interest Bearing Accounts.

- Controlled Money Accounts are bank accounts that are not under the firm's name, normally a third-party investment account.

Editing the Bank Account Configuration

As above - click on the and edit as required

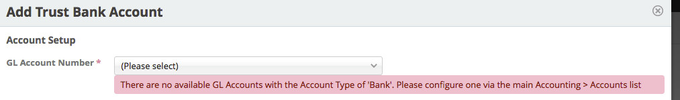

Adding a New Trust Bank Account

From the Bank Account Section of the Trust Configuration use the

Complete as per above.

Ensure that before starting the process there was a General Ledger Account created for the bank or the following error will occur

| Note |

|---|

| Info |

See updated article in Actionstep Help Center: https://support.actionstep.com/hc/en-us/articles/360055348953 |