The ability to receipt funds directly to the IBD accounts has been removed in this version.

There are two scenarios where a deposit would be required:

- Importing opening balances which can be done with the Bulk Importer

- Receiving interest - this can be completed in Multiple ways!

The Interest Menu is at the Bottom of the Main Trust Account Menu.

Importing the Interest

Using the Receive Interest (multi)

The new trust interest importer is designed to capture more information that just the interest amount, for example the ability to deduct firm's fee or tax which was already deducted by the IRD.

This will allow more detail to be captured and used for reporting in the future (like preparing tax information for clients in the future). This data is only available when using the interest specific importer/form which also bypasses restrictions like the inability to receipt funds directly into the Investment account (since funds should always be transferred through the trust current account).

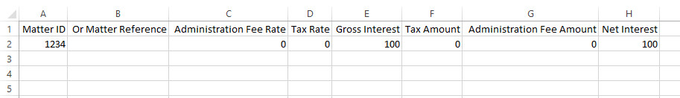

The Import CSV file is reasonably simple, it has 8 columns:

...

So, in an example where there is interest, but no tax or administration fee, the file would be very simple:

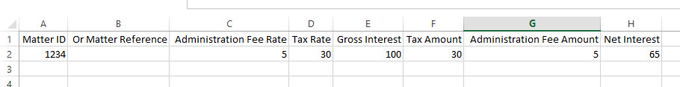

If you enter an administration fee or tax rate, use the actual number (do not put a % in) for example:

This import would create a receipt like the following:

| Warning |

|---|

| The importer will not import the figure entered in as the Gross interest column. Instead this will be calculated based on the Net Interest plus the tax, plus the administration fee. |

Manually Entering Interest Receipts

Viewing Interest Received

Reporting on Interest received for a Trust Account Client

...

| Info |

|---|

See updated article in Actionstep Help Center: https://support.actionstep.com/hc/en-us/articles/360053850494 |