...

On go-live day, you are unlikely to have all of the Account balances to enter into your accounts list. It may be that you run for sometime before being able to enter these.

Depending on your accounting and tax methods, you may need to adjust the balances from the Trial Balance to get them into Actionstep

Considerations

Option 1 - A fully Accrual (Invoice based) Accounting system. So the profit for any open invoices has been included AND Any Sales tax has been returned for the prior period.

- There are no un-presented cheques so there is no bank adjustment required.

- Both the opening balance Debtors and the opening balance Creditors are the full total of the Receivables and Payables from the prior system - there are no P&L Considerations or tax considerations.

- The Sales Tax (Vat | GST) to the end of the prior period is now a debt - so is added to the opening balance Creditors

- Trust account balances (both bank account and liability) are added when entering the Trust account opening balances via receipt to the matters. The Surplus amount is added into the opening balance.

- Current Earnings for the prior Year are now Retained earnings. Note: even if moving part way through the year these would go to Retained Earnings (Current is a calculation only)

Option 2 - Accrual (Invoice based) Accounting system with Payments based tax. So the profit for any open invoices has been included BUT the Sales tax needs to be identified when payment is made

There are no un-presented cheques so there is no bank adjustment required.

- The opening balance Debtors and Creditors are adjusted to be net of Tax

- The Sales Tax portion not belonging to the outstanding Debtors and Creditors ($1780.97) is added to the opening balance Creditors (as it belongs to the prior period)

- Trust account balances (both bank account and liability) are added when entering the Trust account opening balances via receipt to the matters. The Surplus amount is added into the opening balance.

- Current Earnings for the prior Year are now Retained earnings. Note: even if moving part way through the year these would go to Retained Earnings (Current is a calculation only)

Option 3 - Cash Accounting system. Outstanding invoices have not yet been posted to the company accounts or tax.

There are no un-presented cheques so there is no bank adjustment required.

- Depending on the system that you are moving from, it should just be possible to re-enter the data in its original form. The net opening balance Debtors and Creditors are likely to be offset by a clearing account. None of the Income or tax have been recognised so it's just as though you are entering new invoices. If it does not look as though this assumption is correct please contact support@actionstep so that they can help you.

- Trust account balances (both bank account and liability) are added when entering the Trust account opening balances via receipt to the matters. The Surplus amount is added into the opening balance.

- Current Earnings for the prior Year are now Retained earnings. Note: even if moving part way through the year these would go to Retained Earnings (Current is a calculation only)

| Info | ||

|---|---|---|

| ||

Where your practice accounts have unpresented cheques: Add the value to the bank opening balance and the opening balance creditors, then make withdrawals to create unpresented cheques. |

The Process

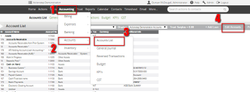

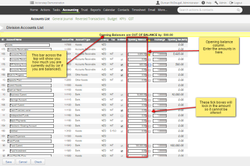

Click image to enlarge

Enter in the opening balance amounts in the Opening Balance column. As you enter each amount the bar at the top of the screen will show as yellow and tell you how much you are out by. Once you have entered all amounts this should change to green.

There is a lock tick box beside each opening balance column. If you tick this the opening balance is locked.

| Warning |

|---|

It is important to note that once locked you cannot unlock the balance. Ever! We would recommend not ticking these boxes when you enter these in a new system so you can give yourself time to come back and make alterations if you notice any errors that need correcting later. |

...

Credit card opening balances have to be entered as a transaction rather than opening balances.

...

| Info |

|---|

See updated article in Actionstep Help Center: https://support.actionstep.com/hc/en-us/articles/360001796368-Adjusting-Opening-Balances |