Introduction

| Tip | ||

|---|---|---|

| ||

For a nice clear overview of the basic principles of accounting in 7 short Youtube videos, we would recommend going here to get started. |

Accounting can seem scary at first; the domain of bookkeepers and accountants using complex terminology like 'debits', 'credits', 'receivables', 'payables', 'depreciation', 'ledgers', and 'journals'.

However, the basic principles of accounting are very easily understood. If you have a personal bank account and household expenses then you are probably already using them. This arcane terminology has arisen from the days before computers where numbers were hand-written into journals by different people and then combined, checked, and re-checked before the books 'balanced'. With computer-based accounting, much of this old terminology is unnecessary.

This course is intended to de-mystify these concepts and to provide you with a basic understanding of how it all fits together.

Table of Contents maxLevel 1 exclude Introduction

General Ledger and the Chart of Accounts

At the heart of all accounting systems is the General Ledger (often called the 'GL' for short). The General Ledger is the place where all account entries are kept. To help you organize the account entries, the General Ledger is divided up into several 'Accounts'. Each Account holds similar types of entries e.g. bank account, rent expenses, salary income, etc. The list of all of the accounts making up the general ledger is called the 'Chart of Accounts'.

In practical terms, (although not 100% technically accurate) you can refer to the General Ledger and Chart of Accounts interchangeably, and people will understand what you mean.

| Panel |

|---|

The General Ledger holds all the account entries. The Chart of Accounts lists all the Accounts in the general ledger. |

Primary Sections

The Chart of Accounts is organized into five primary sections:

- Assets

- Liabilities

- Equity

- Income

- Expenses

Technically speaking, you could get away with running your accounting system using only these five Accounts. The problem with that approach is that it would be difficult to find specific transactions and run meaningful reports. So in practice, you will create several Accounts under each primary section to organize the entries. In basic terms, these five primary sections can be described as follows:

Assets

Things of commercial value (cash, property, furniture, equipment, etc.)

Liabilities

Money you owe (mortgages, unpaid bills, etc.)

Equity

How much you (or the business) is currently worth (i.e. assets less liabilities)

| Panel |

|---|

Equity = Assets - Liabilities |

Income

Money coming in (proceeds from sales, interest income, etc.)

Expenses

Money going out (bill payments, staff salaries, etc.)

| Panel |

|---|

Profit/Loss = Income - Expenses |

Debits and Credits

Debits and Credits are at the heart of double-entry accounting principles, and are also the cause of much confusion and anguish to people who are new to accounting. The confusion is understandable for a number of reasons:

- debits and credits mean different things depending on whether you're looking at them from a business's perspective or from a bank's perspective;

- a debit to one account will increase the balance, whereas in another account it will decrease the balance;

- a 'debt' may sound like a kind of debit, but it's not really;

- an Account can be said to be in 'credit' but that is a different thing to a 'credit entry' in the Account;

- banks issue 'debit cards' and 'credit cards', but these have little to do with debits and credits posted to the Accounts.

To keep it simple, we are going to ignore all the other uses of the words 'debit' and 'credit', focussing only on entries into an Account in the General Ledger.

Each entry of an amount into an Account in the General Ledger must be identified as either a 'debit' or a 'credit' ; this governs what effect the entry will have on the balance of the Account.

| Panel |

|---|

The effect of a debit or credit will depend on which primary section the Account is located under. |

| Panel |

|---|

A debit (of a positive amount) to an asset Account will increase the balance. This is probably the most helpful rule for understanding debits and credits, so find a way to get this permanently etched into your brain! |

| Tip |

|---|

There is nothing logical about this; it is simply something that you have to remember |

Using the above rule, you can usually figure out what effect the other side of the transaction will have.

So for example, if you are going to pay a bill then the bank account is going to decrease (credit). Hence, the other side of the transaction will be a debit. Since the bill is an expense, the transaction will look like this:

| Bank | $100 | Credit |

| Expenses | $100 | Debit |

You can even use this rule if no asset Account is involved in the transaction. Let's say you purchased something via a loan. You would record this as an entry to 'Liabilities' and as an entry to 'Expenses'.

So how do you figure out which is the debit and which is the credit? Knowing we want to increase the balance of the liabilities Account (because we will end up owing more), think about what bank transaction would cause a liability Account to increase. If we took out a loan and added the money to a bank account, then we would be increasing liabilities (that's our aim), and increasing the bank balance (by depositing the loan funds into the bank). If you increase the bank balance, then it must be a debit (according to the above rule), so the liabilities entry must be a credit.

Back to our example: we now know that we need to credit liabilities, and therefore we must debit expenses.

Double Entry Accounting

Another fundamental concept of the accounting framework is that every accounting transaction must be composed of an equal and opposite set of debit and credit entries.

Transactions vs. Entries

A balanced set of debit and credit 'entries' are linked together as a single 'transaction'. The transaction is saved (posted) to the General Ledger as a whole. If any entry fails to save, then the whole transaction is aborted.

| Panel |

|---|

Every transaction must consist of an equal and opposite set of debit and credit entries. |

A DEBIT to Accounts in the five primary sections has the following effect on the account balances:

- Assets (INCREASE)

- Liabilities (DECREASE)

- Equity (DECREASE)

- Income (DECREASE)

- Expenses (INCREASE)

A CREDIT to accounts in the five primary sections has the following effect on the account balances:

- Assets (DECREASE)

- Liabilities (INCREASE)

- Equity (INCREASE)

- Income (INCREASE)

- Expenses (DECREASE)

This is probably best illustrated by an example.

Example 1: Receive Money

Let's say you wish to record the receipt of your monthly salary in your personal accounting system. This will affect your bank balance and your income account.

Your bank account is an asset account so remember the rule 'a debit to an asset account increases the balance'. This means that you will debit the bank account and then to balance out the transaction, you will need to credit the income account.

- Debit Bank $5,000 (increase balance)

- Credit Income $5,000 (increase balance)

Example 2: Mortgage Payment

When you make a mortgage payment, part of the payment goes to interest and the other part to reducing the principal. Money will be leaving your bank account so using the rule 'a debit to an asset account increases the balance' you must be crediting the bank account because you are decreasing the balance. This transaction consists of one credit and two debit entries:

- Credit Bank $2,000 (decrease balance)

- Debit Interest Expense $1,700 (increase balance)

- Debit Mortgage Liability $300 (decrease balance)

The credits and the debits match, so the transaction is balanced!

General Journals

Most transactions are posted to the General Ledger from the appropriate screens in the computer application (e.g. 'Sales', Purchases', 'Banking', etc.). These areas are sometimes referred to as 'source journals'.

However, occasionally you, or more commonly your accountant, will need to make some correcting entries that are not directly related to a source journal. These transactions are known as 'General Journal' transactions (or simply 'GJs').

An example of a GJ is the recording of a depreciation expense of an asset.

Financial Statements

Of the wide variety of reports and statements that you can generate from an accounting system, there are two key reports that underpin the accounting framework; the 'Balance Sheet' and the 'Income Statement'.

Balance Sheet (Statement of Financial Position)

The Balance Sheet provides a summary of your financial position at a single point in time. It does this using the balances in the first three primary sections; Assets, Liabilities, and Equity.

The 'balance' part of Balance Sheet comes from comparing Assets to comparing the difference between Assets and Liabilities. These two amounts should always be in balance.

| Panel |

|---|

Equity = Assets - Liabilities |

Example:

| Assets | $10,000 |

| Liabilities | $3,000 |

| Equity | $7,000 |

| Assets - Liabilities | $7,000 |

The last two figures match, so the Balance Sheet is balanced.

Income Statement (Statement of Financial Performance)

The Income Statement compares income (revenue) with expenses over a certain period of time. The difference between Income and Expenses is the net profit or loss for the period.

| Panel |

|---|

Profit/Loss = Income - Expenses |

Example:

| Income | $12,000 |

| Expenses | $9,000 |

| Profit | $3,000 |

The Balance Sheet and Income Statement are Linked

| Panel |

|---|

Once you understand this point then you will understand one of the central points of accounting. |

Looking at the sample Balance Sheet above, let's say that you now pay a bill for $1,000. This will decrease your bank balance and consequently your total Assets. So your Balance Sheet will look something like the following:

| Assets | $9,000 |

| Liabilities | $3,000 |

| Equity | $7,000 |

| Assets - Liabilities | $6,000 |

This Balance Sheet is out of balance because Equity does not equal Assets minus Liabilities. So what's the problem? It is that the other side of the bill payment went to Expenses (which is on the Income Statement) and reduced the net profit by $1,000. To fix this, we move the net profit (or loss) from the Income Statement and add it under Equity in an account called "Current Year Earnings". Once we do this, the equity will change to $6,000 and the Balance Sheet will balance again.

Examples

Example 1

Let's start with a simple household example.

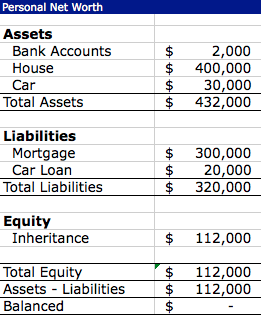

List all the things you own under Assets and any loans under Liabilities. If you subtract the two then you have a snapshot of your net worth ('equity' in business-speak) at that point in time ($112,000 in this example). This is essentially your personal Balance Sheet.

Example 2

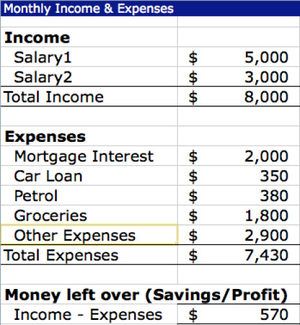

Continuing with the household example, list all sources of income and expenditure in a typical month.

In this example we are assuming that the household has two salary earners.

What you see below is essentially your personal Income Statement for the month. You have earned $570 more than you spent during the month, so this can be retained as savings ('profit' in business-speak).

Example 3

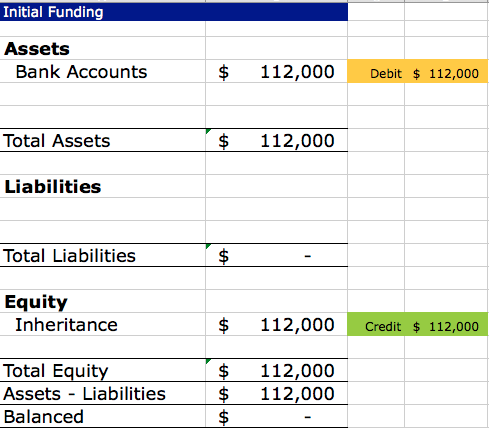

Let's now take a look at how the individual debits and credits are entered to make up the Balance Sheet and Income Statement. To make things easier to understand, we are going to start with a blank slate and assume that you have just received an inheritance (wouldn't that be nice!). You have decided to start recording your personal finances from this point forward.

According to the 'double-entry' principle, we need to enter a debit and a credit to record the receipt of the inheritance. So in this case we debit the bank account (debits increase Asset accounts) and credit the inheritance account under Equity (credits increase Equity accounts).

There are no liabilities so Equity = Assets - Liabilities; everything is balanced.

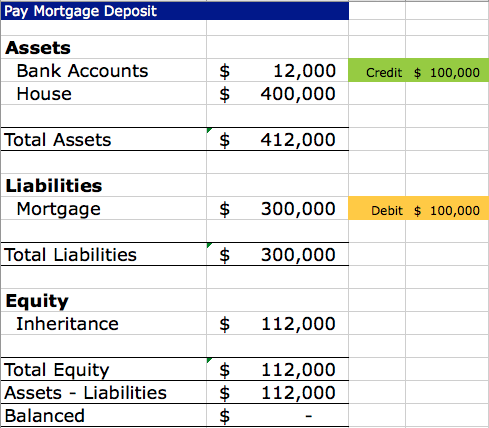

Example 4

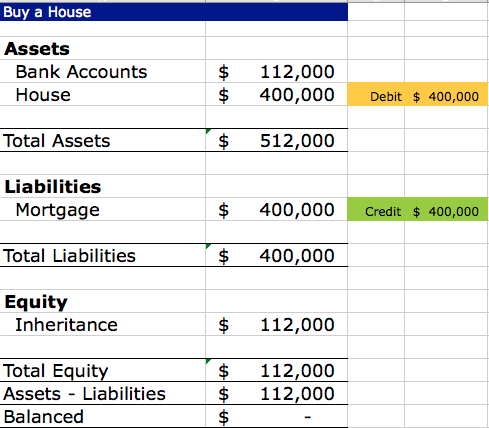

Now that the money is in the bank, what should we do with all this new wealth? Let's put down a $100,000 deposit and buy a house!

Normally you would record all the entries in a single transaction, but for clarity, let's do this is two stages. Firstly, let's record the purchase of the house with the full mortgage as a Liability.

We haven't paid the deposit yet so all we are doing is creating a new asset (debit house $400,000) and an equal offsetting liability (credit mortgage $400,000).

Equity = Assets - Liabilities, so we're still all balanced.

Now let's pay the deposit. Credit bank $100,000 (credit to an Asset account decreases the balance), and debit the mortgage $100,000 (debit to Liability account decreases the balance).

Equity = Assets - Liabilities, so we're still all balanced.

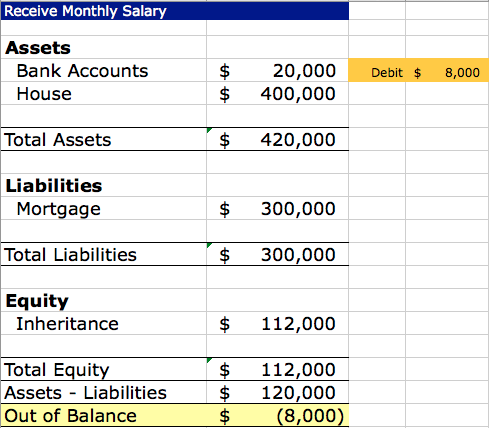

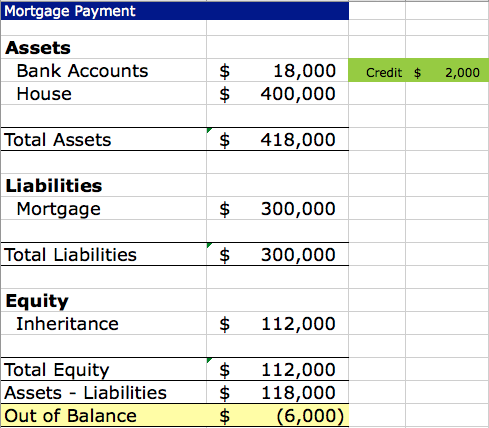

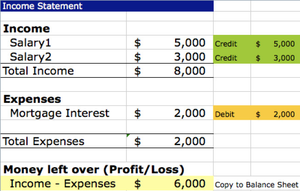

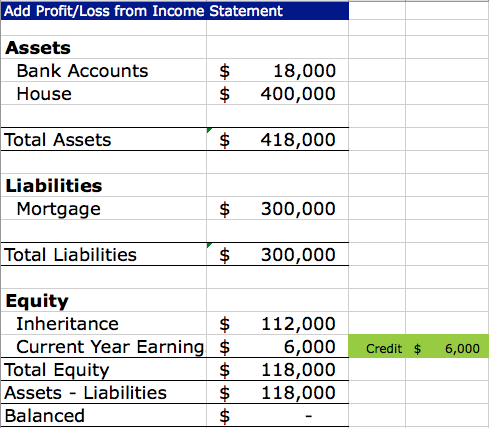

Example 5

Now let's record your salaries for the first month and make your first mortgage payment. For simplicity, we will assume that this is an interest-only payment.

Debit the bank $8,000 for the salaries.

Credit the bank $2,000 for the mortgage payment.

Oops, the Balance Sheet no longer balances! The reason for this is that the other side of the previous two entries were recorded under Income and Expenses, which are not Balance Sheet accounts.

This is where we connect the Income Statement and the Balance Sheet. In order to get everything to balance, you must move the net result of the monthly change in Income and Expenses to the Balance Sheet.

In this case we have mode a "profit" of $6,000 for the month, so our net worth (or Equity) has increased by $6,000 from where we started. Therefore move this to the Balance Sheet under the Equity section. This is normally entered under an account called 'Current Year Earnings'.

Equity = Assets - Liabilities, so we're still all balanced again.

...

In reality, mortgage payments are normally a combination of interest and capital and so you would record it as follows:

...

Receivables and Payables

In most businesses, the process of buying and selling is accomplished through the exchange of 'invoices'. An invoice lists the items, the price, tax component, and payment due date. Payment is not normally required immediately and 'credit terms' are extended to the purchaser, giving them a certain amount of time to pay (2 weeks, 1 month, etc.).

When the invoice is created, the sale (or purchase) is recorded in the accounting system. However, since no money is actually received or paid, at that point you cannot record the entry in the bank account. To deal with this, special Asset and Liability accounts are created to record these anticipated payments. These are called 'Accounts Receivable' (asset account) and 'Accounts Payable' (liability account).

To record a sales invoice, the entries would be as follows:

...

When you receive a payment, the income remains unchanged since the sale has already been recorded, and you simply record the payment to the bank account, and remove the amount from Accounts Receivable.

To record a sales invoice payment, the entries would be as follows:

...

The same process would occur for purchases, except that you would use the Accounts Payable account instead (and the debits and credits would be swapped).

"Aged" Receivables/Payables

At any point in time, the current balance of the Accounts Receivable or Accounts Payable show you the net amount of money owing to you by customers (or how much you owe to suppliers). Because each invoice has a due date, it is important to know which of these amounts are overdue and require attention.

The Aged Receivables and Payables reports will list all unpaid invoices, with columns grouping overdue payments by how much they are overdue (30-days, 60-days, 90-days, etc.)

Debtors and Creditors

Traditionally customers who owe you money are called 'Debtors' and suppliers to whom you owe money are called 'Creditors'.

Cash vs. Accrual Methods

'Cash' versus 'Accrual' accounting methods are simply a means of dealing with sales and purchases for tax purposes. The issue arises from the difference in time between recording the invoice in the accounting system and receiving the payment.

Using the cash method tax is only assessed when payment is made/received.

Using the accrual method tax is assessed on the invoice date.

The choice of cash versus accrual method is most often left for the company to decide; for large corporations accrual is sometimes the only option. The reason for choosing one method over the other can be quite complex, but generally has to do with optimising cash-flow, or making sure that profits are recorded in the correct periods.

Some companies may elect to use one method for tax purposes, but may still run financial reports in both methods to compare their cash position with their financial position.

Sales Tax (a.k.a. GST, VAT)

In some jurisdictions, businesses are required to collect sales tax on the goods and services that they sell and pay this through to the government. The amount of sales tax the business owes to the government is reduced by the amount of sales tax it pays to its suppliers.

In cases where business buy more goods than they sell in a certain period, the government will pay the business a cash refund. The timing of the sales tax payments to/from the government will depend on whether the business has elected to report on a cash or accrual basis.

Sales tax is sometimes called 'Goods and Services Tax' (GST) or 'Value-Added Tax' (VAT).

When you record a sale with a sales tax component, only the tax-exclusive portion is recorded under income, and the sales tax component is recorded as a liability (since you owe this to the government).

The transaction would look something like (assuming 10% sales tax):

| Accounts Receivable (Asset) | $110.00 | Debit (increase balance) |

| Product Sales (Income) | $100.00 | Credit (increase balance) |

| Sales Tax Payable (Liability) | $10.00 | Credit (increase balance) |

Capital vs. Revenue Expenses

Normally when you buy something for the business, you will be exchanging cash for something of equal value, so there should be no change to the Balance Sheet after the purchase. Essentially all you would be doing was moving the amount between Asset Accounts.

For example, if you buy a new computer:

| Bank (Asset) | $2,500 | Credit (decrease balance) |

| Computer Equipment (Asset) | $2,500 | Debit (increase balance) |

The total Assets remain the same and so the Balance Sheet is unchanged.

This works for large items of tangible value, however if you are buying smaller items (e.g. paper clips and pens) you would not want to go through all of the trouble of recording these as Assets; they only have a limited lifespan and would be difficult to re-sell to recover the cash. For these items, it is more convenient to treat them as an Expense. The transaction would look like this:

| Bank (Asset) | $15.23 | Credit (decrease balance) |

| Office Supplier (Expense) | $15.23 | Debit (increase balance) |

(The slight decrease in profit for that month as a result of this expense would be included in "Current Year Earnings" to balance the Balance Sheet).

So obviously, some line needs to drawn in the sand to decide whether an item should be recorded as a Capital Expense (and recorded as an Asset), or as a Revenue expense (and recorded as an Expense). The local tax jurisdiction will define these limits and you need to be aware of them in order to code your entries correctly.

Depreciation

The computer that was purchased for $2,500 in the above example will not hold that value forever. After a year or two, you would probably only be able to sell it for about $1,000. However, as it is still listed under Assets for $2,500, your Balance Sheet would not be giving you a true snapshot of your business value at that time.

What you need to do is to periodically 'depreciate' your assets. This means that you need to remove part of the value under Assets, and push this through to Expenses. Let's say that at the end of the first year you decide that the computer is only now worth $1,800. You could then enter the following transaction to correct the Balance Sheet:

| Computer Equipment (Asset) | $700 | Credit (decrease balance) |

| Depreciation(Expense) | $700 | Debit (increase balance) |

In practice, the tax authorities set the amounts you can depreciate your assets by over time. Some of the more common methods you might hear about are "straight-line method", "declining-value method", etc.

Terminology

...

Account

...

A names section of the General Ledger that holds similar entries

...

Account Entry (Entry)

...

A single amount entered into an Account. Each entry is either a debit or a credit.

...

Debtor

...

A customer with unpaid invoices.

...

Creditor

...

A supplier that you need to pay.

...

Current Year Earnings

...

Profit/Loss from the current financial year recorded on the Balance Sheet

...

Financial Year

...

The 12 months period used for financial and tax reporting purposes. The financial year end date may be different to the calendar year end.

...

Retained Earnings

...

Profit/Loss from the prior financial year recorded on the balance sheet

...

Transaction

...

| Info |

|---|

See updated article in Actionstep Help Center: https://support.actionstep.com/hc/en-us/articles/360052068374-Accounting-Basics |