Please note that this concept does not apply to all jurisdictions. If you are unsure of whether this is relevant, please review the guidelines for the Law Society that you report to.

The Firm's Interest in Trust denotes the amount of the funds within a trust account that do not belong to clients. The Firm's Interest in Trust was previously recognised as "Trust Surplus" in previous releases of Actionstep Trust Accounting. It can be used for Client Advances (where the client is short of funds to pay another party).

To adjust the firm's interest in trust, simply access Trust → Firm's interest in trust → Adjust Firm's interest in trust

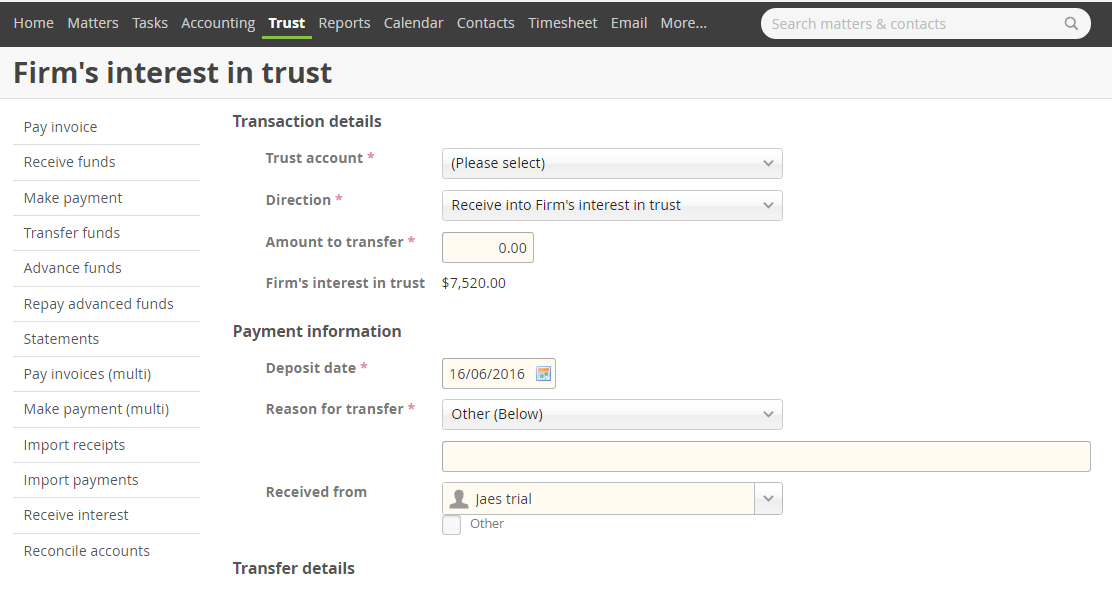

This will take you to the following page:

Trust account: Select the relevant trust account to pay from/into. Usually this would be the trust current account.

Direction: You can either Pay from the Firm's interest in trust or Receive into Firm's interest in trust. You will want to pay from the firm's interest in trust into the business current account as part of fees from a client, whereas paying into the firm's interest in trust would typically be to cover funds for paying advances where the amount of a payment exceeds the balance of that client's trust funds on a matter.

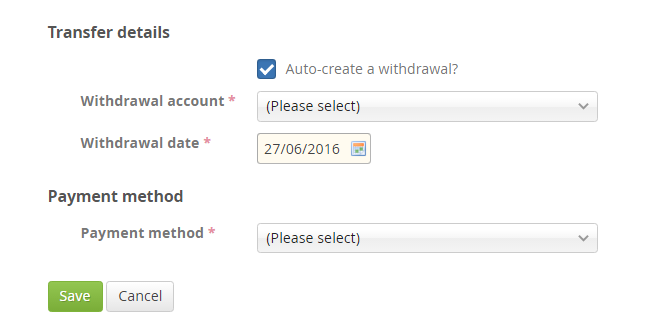

Auto-create a withdrawal: unticking this checkbox will effectively disable the second half of the transaction, leaving the funds sitting in the holding account (Trust Transfers).

Entering Opening Balances for Firm's Interest in Trust