The Bank Reconciliation for Trust Accounting V3 has additional functionality which will later be incorporated in to the general accounting functionality. These include:

- The ability to create "Adjustments" this allows for the entries to accurately represent the movements in your bank account.

- The ability to report a consolidated view of all reconciliations within a month as one report.

For AUSTRALIAN Plugins

The Bank Reconciliation for Australia (except Queensland) will now show all entries at entry date rather than transaction date - this may mean that you need to do adjustments in cases where you have back entered transactions after the end date of the Rec.

The Trust Bank Reconciliations are now part of the Trust menu rather than the Accounting menu.

Creating a New Trust Reconciliation

Important: there are three requirements that need to be met in order to open a new reconciliation:

- All the days of the previous month must have been reconciled in a separate reconciliation. This means that if your last reconciliation was for the 29th of March, you will need to open a new reconciliation for the period 30 - 31st March (you can do this against a downloaded bank statement) before you can open a new one for April.

- A new reconciliation cannot relate to two different months. For example, you cannot open a new reconciliation for the period between 19th of March - 18th April. You will need to set the end date of the reconciliation as 31st March and open a new one for the April period. This also breaches requirement 1.

- A reconciliation cannot span for more than a month. That is, you would not be able to open a reconciliation for the period between 29th March - 30th April. This also breaches requirement 1.

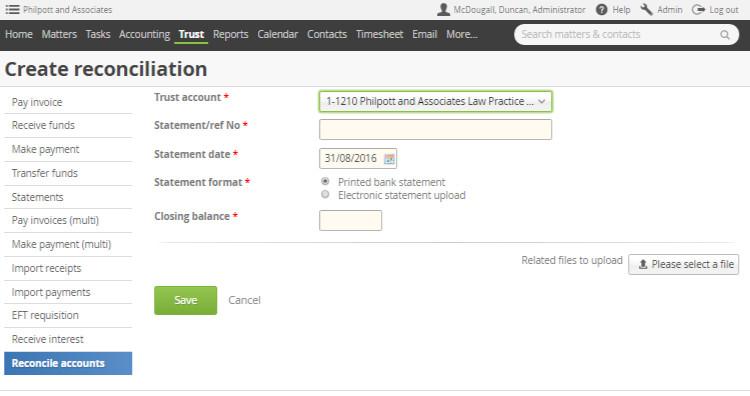

To create a new trust reconciliation go to Trust > Bank Reconciliations > Create Reconciliation. You are also able to select from the Trust bank reconciliation list. Lastly, the most recent bank reconciliations can also be accessed from the Trust Admin Bank Accounts.

FIll in the details of the bank reconciliation on the Create Reconciliation screen

Trust Account Choose the Account you want to reconcile.

Statement/ref no. This is a reference that you can use to help you identify this reconciliation.

Statement date The date you are reconciling up to

Statement format You can do either an electronic bank reconciliation which requires you to upload a file from your internet banking into Actionstep or use a printed bank statement to reconcile against. The Electronic statement will allow Actionstep to automatically reconcile entries in the file uploaded to entries entered into Actionstep based on the transaction date and amount. The Manual process gives you a list of transactions in the trust account in Actionstep and you can mark each as complete when you find the matching entry on your statement.

Closing Balance This is the bank account balance as at the end statement date.

Processing your Trust Reconciliation

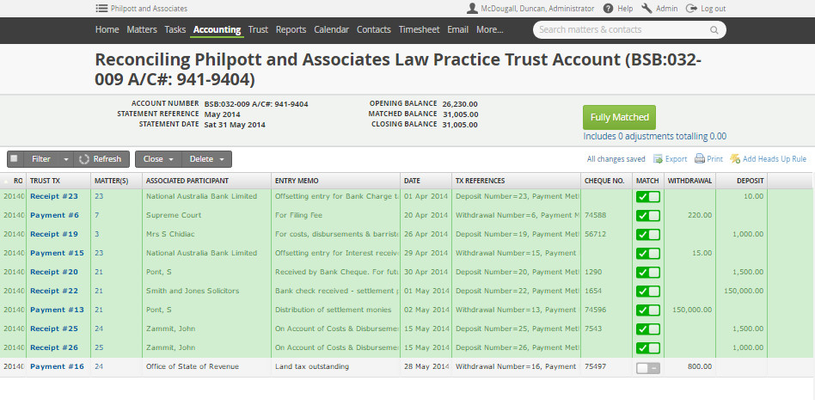

If you are completing a manual bank reconciliation you will be presented with a list of trust transactions as they have been entered into Actionstep. Click on the box in the "Matched" column to show that that item matches an entry in your bank statement.Any unmatched items will be considered unreconciled.

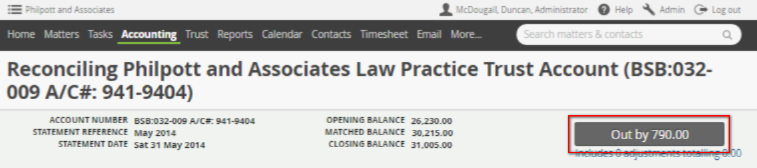

Up the top of the bank reconciliation will be a grey button which will tell you how much your reconciliation is currently out by. As you match off item in the list this figure will change.

When the statement reconciles a the button will change to a green button. Clicking this will take you through to the confirmation screen.

Making adjustments to your Trust Bank Reconciliation

If you have entries that are appearing in your bank statement but are not in Actionstep, you are able to make adjustments to balance your Bank Reconciliation.

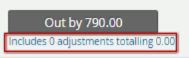

Click the link below the "Out by..." button to enter in a new adjustment.

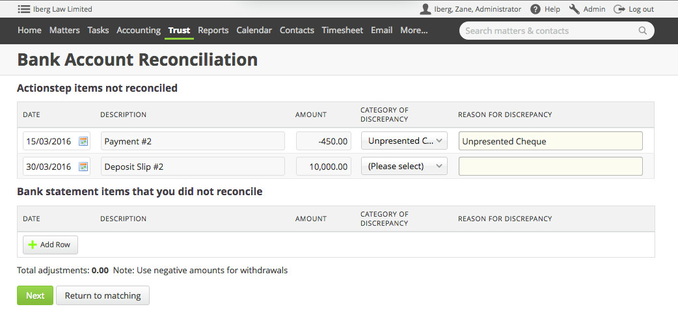

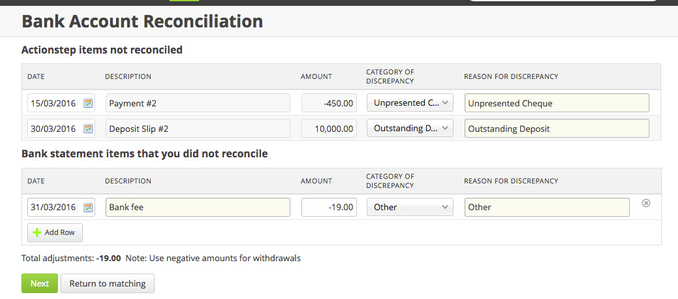

This will take you through to the screen below.

This screen will also populate automatically with any transactions not selected in the reconciliation - giving the ability to analyze and comment on the outstanding. When you select the discrepancy category it will automatically populate the reason but you should change the reason if it appropriate to include more details.

For any adjustments - add as required (using a negative for a withdrawal).

Clicking Will take you through to the summary and allow a Reconciliation completion.

Edit or Delete a Trust Bank Reconciliation

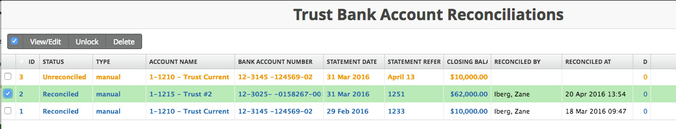

Trust > Bank Reconciliations > Reconciliations List

Clicking a reconciliation will take you through to the detail of the reconciliation. If the reconciliation is not complete (in orange line) you will be able to continue through.

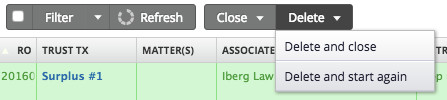

For a completed reconciliation (in blue), to open for edit check the box beside the reconciliation and the ability to "Unlock" will come up in the top bar. Note: if there is already an open reconciliation for that account you will need to delete it first. The system only allows one reconciliation open at anytime for each account. To delete a reconciliation it would need to be in an editable state first.

When inside the Bank Reconciliation the delete button is also visible.

Trust Bank Reconciliation Reporting

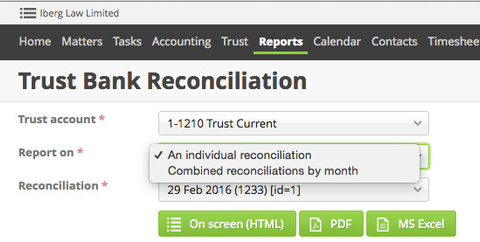

The Trust Bank Reconciliation Report can be found under the Reports > Trust.

The ability to report on an individual Reconciliation (where the default is the last complete reconciliation), or a combined monthly reconciliation is available. The combined Month

The "Combined reconciliations by month" option allows those people who reconcile multiple times during a month to have one report which gives a month together.