Actionstep Accounting has an extremely rich feature set which is beyond the requirements most of our clients would use. There are many ways to do most things - this enables strict permission set capabilities.

We understand that all companies have a different process they would like to follow, and all users work in a different manner. You will in time find the best fit for your needs and users, here are some pointers to get you going.

Work Smart

Below are some Tips for using Accounting

Document Uploading

The ability to upload a document against an accounting transaction is a highly valuable feature of Actionstep. We recommend using Actionstep with dual screens to unleash the full potential.

Encourage your suppliers to send their invoices via email and enter off the PDF. Simply upload the PDF to the transaction. Never again will you need to dig around in a file in order for you manager to authorize a bank batch - he can just look at the invoice if he has any questions (as can the external accountant).

Bank statements can be uploaded against the reconciliation for proof of transactions.

EMail Templates

Configure set text to accompany invoices and statements. Remember anything you say more than once - Actionstep can be trained to say for you.

Document Merge Fields

Configure your Sales Invoices (Client Bills) to pick up any information from the Action.

The Action Name & Number, a specially built field with the scope, a narration regarding the description of the matter. All merge fields which can be used in a Document template for your workflow type can be merged into the Invoice.

Template, Template, Template

We just can't stress it enough, all accounting transactions can have a Template - this saves time and inaccuracy when entering.

Contact Sharing

Actionstep does not work on the model where for each role a contact fills, it needs a new record.

Your contact could be both a client and a supplier - no need to enter them twice.

Duplicate check is performed by the system every time a contact is added.

Easy Searching

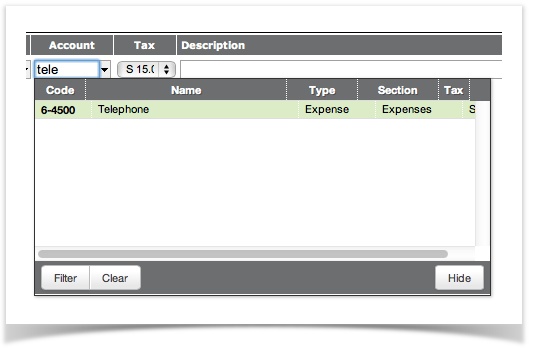

Our searching allows you to search and account code either by name or number.

No need to have an accounts list beside you while entering accounting transactions.

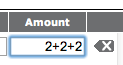

Addition within a cell

When you need to calculate the value of a line item on the fly while entering - simply perform the calculation in the cell

and hit enter for the result

A Standard Usage Scenario

Overview

Below is an overview of where a Professional Services Office should look for their Accounting Process using ActionStep. This should facilitate a speedier navigation of the User Guide and enable training.

Where the business Income is derived mostly from people with a portion of recharges rather than complex product sales, the accounting process can be achieved using the simpler components of our system.

This is written with the assumption that your system has been configured correctly.

Billing|Sales|Debtors

Every business uses some form of selling for Income. The ActionStep system carries a vast amount of functionality and options around the sales capability.

Where time is the major billable item we suggest the following:

- Use the “Action Billing” via workflow to Invoice the clients. Where direct recharges to clients for a purchase will occur, they will be available in Action Billing once purchased.

- Ensure the rate sheets are set correctly see Dealing with Rate Sheets

- Billing Preferences should be set for the information you require on output.

- The Docx Invoice Template/s have been tested and checked in line with billing preferences.

When a client pays:

- You will either be receipting this via Trust Accounting and applying.

- Where Trust Accounting is not involved, ee suggest you receipt this via the accounting module where multiple deposits can be receipted in one screen.

Managing Debtors

Once you have completed both your billing and your bank reconciliations, we suggest you send out debtor statements.

Costs|Purchases|Creditors

While staff may be your primary cost, other expenses cannot be avoided. Some of these will come in the form of supplier invoices. While these can be paid using the Banking section, we do not recommend this approach as it can distort Profit.

- Set up Templates for regular suppliers to minimise entry time when invoices arrive.

- Use the Quick Entry method to enter supplier invoices.

- Pay Suppliers using the Batch Export facility where available.

- Reconcile your creditors monthly against their statement prior to paying.

Banking|Bank Reconciliations

For those transactions where the cost may be a regular monthly payment made within the same month (ie Rent, payroll), a onetime payment, or another type of transaction not related to Debtors or Creditors we suggest creating a bank transaction to process this. A bank transaction does not require the participant to be available in your contacts list.

- Create templates for regular payments.

- While the banking side does have the ability to have a transfer between accounts we suggest a template withdrawal or deposit for these too.

- Reconcile the bank accounts on a regular basis – monthly at a minimum,

General Journals

There will be times when a General Journal is required, some examples:

- Error Fixing

- End of Year adjustments from the Accountant (depreciation)

- WIP (to put the value of Work in Progress into your financial accounts)

- Accrual and pre-payment adjustments